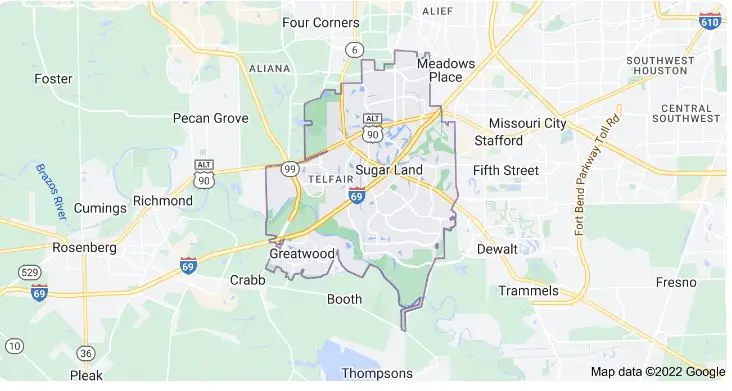

High Rise Financial offers the bestlawsuit loans in Sugar Land. We also have pre settlement funding professionals on the team who can handle any queries you might have regarding our settlement loans.

Our pre-settlement funding professionals are highly skilled. These experts just need you to be satisfied with our sugar land settlement loans. They expect you to have faith in our expertise to provide pre settlement loan that fits your needs.

We make sure that every lawsuit loan application is dealt with as soon as possible. We also maintain open channels of contact. Please tell us how we could help you with your needs. And we’ll do everything we can to make sure you have a wonderful experience during our legal funding procedure.

Qualify for a Lawsuit Loan Today

While your case is pending, pre-settlement funding can assist you in covering your living expenses and other necessities. We can do so by providing you with legal funding before the settlement of your case.

It’s a non-recourse cash advance, meaning you only pay it back if you win or settle your case in court. But remember that we provide settlement loans as per state law of negligence.

Texas follows Modified Comparative Fault Law– 51% Bar from Sec. 33.001 Proportionate Responsibility. It states, “A claimant may not recover damages if his percentage of responsibility is greater than 50 percent.”

High Rise Financial has customers covered in personal injury lawsuit loans, vehicle accident lawsuit loans, or other lawsuit loans. Unlike payday loans or car titles, your credit record and financial background do not influence the qualifying procedure.

The details of your lawsuit will be all that counts to us. We take on plaintiffs who have suffered whiplash, fractured bones, brain damage, and spinal injuries.

To apply for free, call (877) 735-0016

What Terms Do You Need to Learn About Settlement Loans?

What Terms Do You Need to Learn About Settlement Loans?

If you wish to seek lawsuit loans, you must work with a lawyer. Throughout the settlement funding procedure, we speak and coordinate with your attorney.

Our pre settlement loans have no “hidden” costs. Instead, we give you a settlement loanquotation that specifies the amount you can borrow. Our estimate also includes details regarding the interest rate on your settlement loan.

We collect interest on our pre settlement funding. However, we try our utmost to maintain this rate as low as possible. On our lawsuit loan, we also don’t compound interest.

Sugar Land Pre-Settlement Funding Lawyer Near Me (877) 735-0016

What is the Minimum Amount of Money I Should Put Aside for Lawsuit Funding?

You don’t have to put money aside for a settlement loan. However, budgeting your finances might be advantageous. You may plan out your everyday finances in line with your lawsuit loan by following a budget.

The duration of your legal actions might range from several weeks to months or even years. In the meanwhile, you might have to depend on your settlement funding for the duration of your legal battle. Meanwhile, those who prepare ahead for pre settlement funding can prevent financial risk.

When you submit your lawsuit loanapplication, we recommend you analyze your financial situation. This allows you to view how much money you have available right now. It also aids in planning how you will spend your legal funding.

Choose High Rise Financial for Your Lawsuit Funding Needs in Sugar Land

For plaintiffs involved in car accidents, product liability, slip and fall, and others. We offer lawsuit loans in Sugar Land. Our pre settlement funding experts can assist you in weighing your lawsuit loan options and making an informed decision.

Contact us at (866) 407-6404 or submit our online lawsuit loan application for further queries.

Call or text (877) 735-0016 or fill out our form to apply today for free.

What Terms Do You Need to Learn About

What Terms Do You Need to Learn About